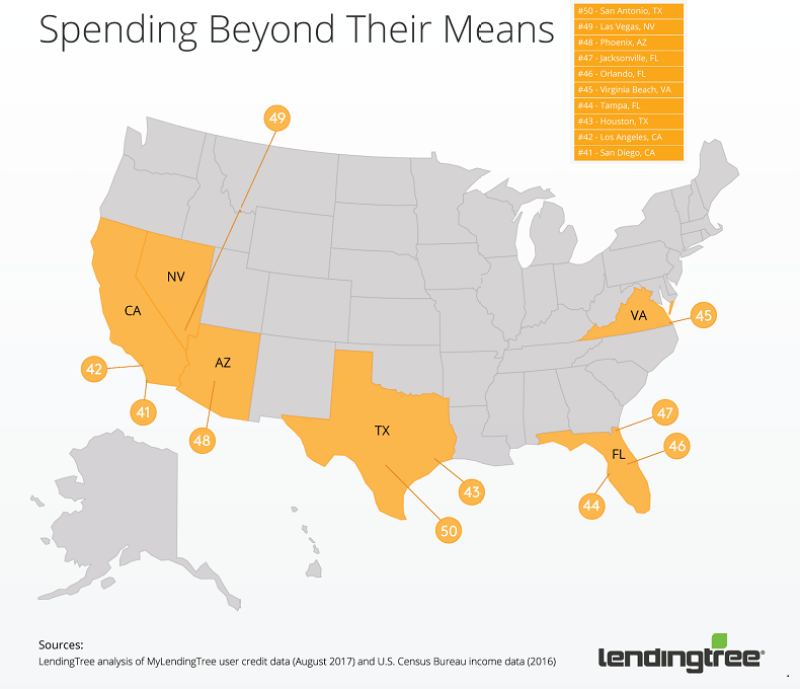

Researchers for Lending Tree recently came up with a formula to determine which U.S. cities' residents rely most on borrowed income, and two major Texas cities flunked the test.

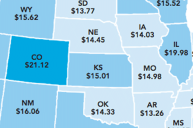

The report paired census data on average income in 50 major metropolitan areas with anonymous credit data, creating a "Spending Within Your Means Score" of 0 to 100. The average number of credit inquiries, use of revolving credit, non-housing debt balances as a percentage of income and mortgage balances impacted scores.

Lending Tree

San Antonio finished last, due to a population that averaged seven credit inquiries per year over the past two years. Credit inquiries matter because they imply that the people in a geographic area seek more credit to fulfill their lifestyle. Further, the report claims that non-housing debt balances represent 55 percent of residents' annual income. Despite an average household income of $76,000, San Antonio spenders carry an average installment loan balance of $30,599. In short, there's excess there beyond excessively hot hamburgers.

Houston barely scored better, ranking 43rd overall. The survey ties over 70 percent of debt income in the Houston metro area to mortgages. Houston households, which made around $60,000 per year as of 2015, get flagged for five credit inquiries per year.

On the opposite side of the list, the Carolinas scored well. The top two cities are Greenville, S.C. and Greensboro, N.C., with Charlotte rounding out the top five.

As far as surprises go, the people of San Francisco know how to live within their means. The fourth largest city in California ranks an impressive seventh on the list, aided by an average household income of over $100,000. Likewise, Sacramento, San Diego and Los Angeles rank 40-42 on the list.